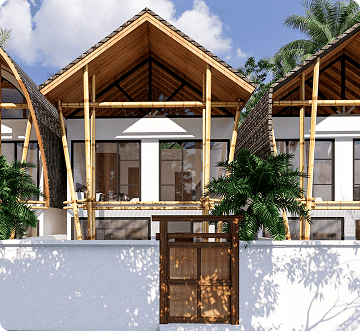

Invest in the Heart of Indonesia’s Next Real Estate Boom

From luxury resorts to SEZ-backed infrastructure, Lombok is quickly becoming Southeast Asia’s most exciting property market — and it’s still early.

| 5% ANNUAL GROWTH

Lombok’s tourism has grown by over 15% annually in recent years — a clear indicator of rising global demand and investor opportunity.

Why Invest in Lombok?

Lombok is what Bali used to be — pristine beaches, rising tourism, and property prices that still make sense. While South Bali is oversaturated and rental returns are shrinking, Lombok is just getting started.

Backed by multi-billion dollar government projects (SEZ, airport, MotoGP)

Entry prices 30–50% lower than Bali or Australian markets

Forecasted 50–80% capital gains during pre-construction phase

Rental yields of 8–20% annually, depending on property type

Strong tourism growth with direct international flights

How You Can Invest

You don’t need millions, and you don’t need to be a seasoned investor. We’ve made it easy, whether you’re investing for income, growth, or retirement.

Use Your Superannuation Fund (SMSF)

If you’ve set up a Self-Managed Superannuation Fund, you can legally invest in offshore property. We’ll help you structure everything, from compliance to returns.

Buy Outright

Perfect for those who want full ownership and high returns. Properties start at AUD 75,000 AUD, with flexible layouts and pre-construction pricing.

Use Developer-Backed

Finance

Prefer to stage your payments? We work with developers who offer structured finance plans — pay a deposit now and settle the balance on completion.

What You Get with ROI Investments

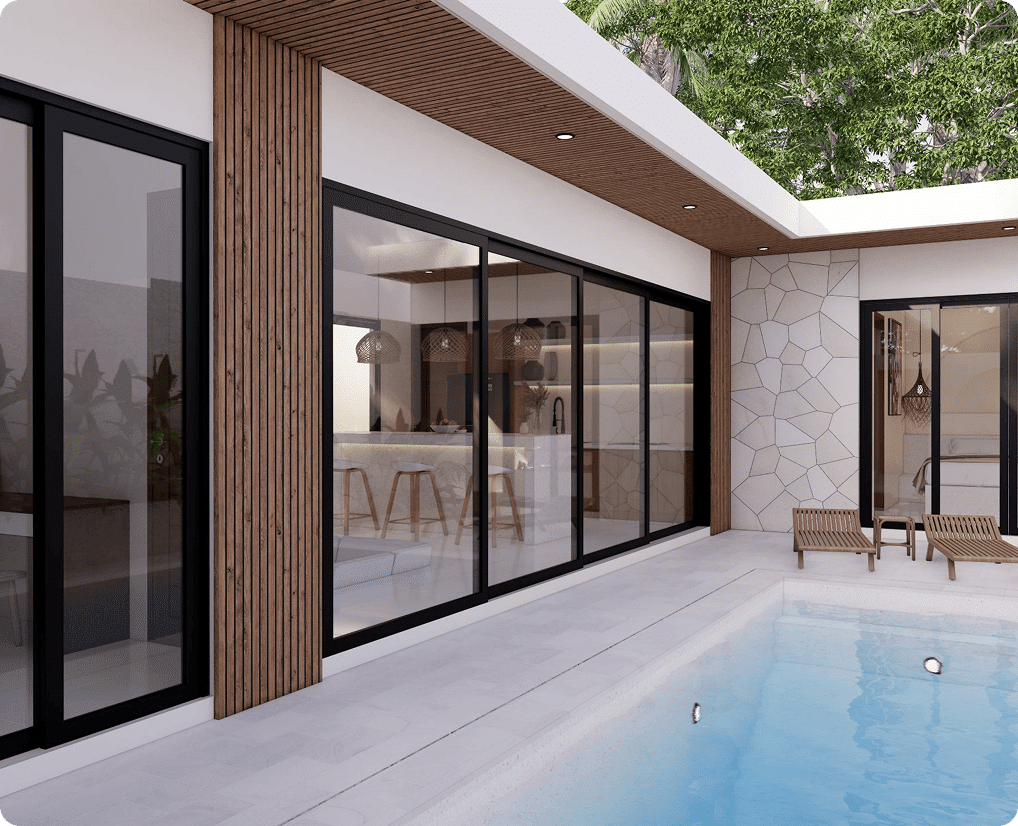

Access to off-market, pre-construction villas and resort units

Exclusive pricing and early-stage opportunities

Full legal & contract assistance

Rental management and hands-free ownership

Ongoing investor support, reporting, and resale strategy

Real Investment Outcomes

Our current projects offer:

Capital growth of up to 80% within the first 12 months

Rental income from $2,000 to $20,000/month

Net ROI of up to 46% per year

Break-even in as little as 2.17 years

“I didn’t even know I could use my superannuation fund for overseas property…”

“I used my superannuation fund to buy into a pre-construction gated villa. It's already appreciated by 40%, and I haven’t even visited it yet. ROI handled everything.”

Simon Norris

Perth, Australia

Security, Transparency, Confidence

We only partner with trusted developers, licensed advisors, and experienced legal teams. Every deal is fully backed by signed contracts and local compliance. No guesswork. No hidden fees.

Frequently Asked Questions

WHAT TYPES OF PROPERTIES CAN I INVEST IN THROUGH ROI INVESTMENTS?

We offer access to pre-construction villas, resort units, and gated community homes in Lombok and East Indonesia. These are high-growth areas backed by government infrastructure and tourism development.

IS LOMBOK REALLY A BETTER INVESTMENT THAN BALI?

Yes. While Bali is facing oversaturation and declining rental yields, Lombok is in early growth stages — with large-scale infrastructure, rising tourism, and significantly lower entry prices. It’s one of Indonesia’s fastest-growing regions, offering first-mover advantages to investors.

HOW MUCH DO I NEED TO GET STARTED?

Properties start from around AUD 75,000 AUD, with both full purchase and developer finance options available. We also offer fractional investments for lower entry points.

CAN I INVEST USING MY SUPERANNUATION?

Absolutely. If you have a Self-Managed Superannuation Fund (SMSF), you can legally invest in offshore property. We work closely with licensed SMSF advisors to ensure your investment is compliant, structured, and profitable.

WHAT KIND OF RETURNS CAN I REALISTICALLY EXPECT?

Many of our clients see capital growth of 50–80% within the first 12 months of construction, and net rental returns of up to 46% annually depending on the property. We provide detailed forecasts and real-world examples for every opportunity.

contact us